Blog

Finance Advice

What Is Financial Planning Software? And Why Startups Need It

Learn what financial planning software is, how it helps startups forecast, budget, and plan smarter, and why founders choose Parallel for real-time insights, scenario modeling, and effortless runway tracking.

Renato Villanueva

CEO & Cofounder

Oct 21, 2025

Every founder knows that managing a startup’s finances is messy and confusing. Multiple spreadsheets. Manual data imports. Missed costs. Unclear runway.

Financial planning software is the tool that fixes that. It’s the backbone of smarter decision-making. In this post, we’ll explain what financial planning software is, how it works, why it's essential for startups, and what features to look for.

Key Takeaways

What financial planning software is and how it differs from spreadsheets

Why startups need real-time visibility into cash, runway, and growth

The core features founders should expect from a modern planning tool

How financial planning software supports better forecasting and decision-making

Why startups adopt planning tools earlier as complexity increases

What Is Financial Planning Software?

Financial planning software is a platform that helps businesses forecast revenue and expenses, build budgets, run scenario modeling, and generate reports in one unified system. Instead of manually stitching data across tools, the software automates many of those pieces:

Pulling in actuals from your accounting, payroll, and revenue systems

Updating forecasts continuously

Allowing “what-if” modeling (e.g. hiring, fundraising delays)

Producing board decks or investor-ready visuals

In short: it’s software that transforms forecasting, budgeting, and modeling from spreadsheets into a living system.

Why Startups Should Care

You might think financial planning software is something for later-stage companies. But in fact, the earlier you adopt it, the more you benefit:

Visibility & accuracy

You eliminate manual errors, version mismatches, and stale models. As soon as your revenue or costs change, your forecast adjusts.Speed & confidence in decisions

When you can test hiring, pricing changes, or fundraising outcomes in seconds, you make less gut-based decisions and more data-based ones.Investor readiness

Founders often scramble during fundraising to clean up messy models. With the right software, your forecasts, scenario decks, and metrics are already polished.Scalability without chaos

As you grow, a robust financial planning system scales with you. No need to rearchitect your finances at every round.

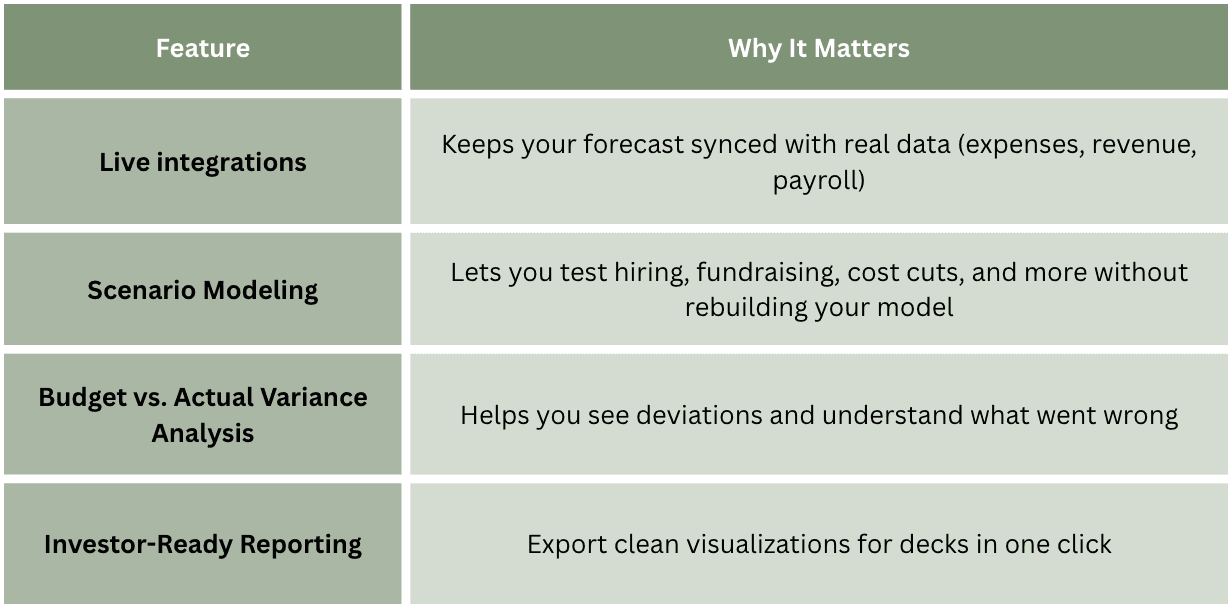

Core Features That Matter

Not all financial planning software is equal. Here are the must-have features founders should look for:

When a tool has these features, you stop treating financial planning as a burden and let it truly inform growth.

Common Misconceptions

“We don’t need software yet, spreadsheets work fine.”

They do early on, until they don’t. As assumptions shift, spreadsheets break and can’t keep up. Using software enhances your spreadsheets and allows you to easily transform them into live, working models.“Financial software is too expensive for startups.”

Only if you pick tools meant for large enterprises. The right software has pricing built for early-stage founders.“We still need a finance team for this stuff.”

You eventually will, but early-stage founders can use modern tools to act like a mini-CFO before hiring one. When you do hire a finance team, the right software will be a tool they can keep using.

Why Parallel Is the Best Option for Founders

Parallel was built from the ground up for startup founders, not accountants. Here’s how it checks all the boxes (and adds more):

Real-time forecasting: Actuals and forecasts stay in sync automatically

Scenario modeling: Test hiring, fundraise timing, or cost shifts instantly

Smart guidance: Parallel surfaces tradeoffs and risks so you don’t miss blind spots

Fast reports: Generate polished, board-ready models in minutes

Transparent pricing: No hidden fees; starter price designed for early-stage startups

Service and analysis: Parallel has a service feature, explaining insights and providing suggestions

When you use Parallel, forecasting stops being a pain and becomes a strategic advantage.

How to Get Started

Connect your accounting, payroll, and revenue tools

Build your first forecast (revenue, hires, expenses)

Run scenario tests: delay hires, increase revenue, push fundraising

Use your model to plan runway, hiring, and growth decisions

In short: don’t wait until the financial chaos hits. Build your foundation early. Let your forecasting system grow as your startup does.

Try Parallel today and make your financial planning live, not reactive.

FAQs

What does financial planning software do?

It helps startups track, forecast, and plan their finances in one place. It automates budgeting, forecasting, and scenario modeling so founders can make data-driven decisions without endless spreadsheets.

Why do startups need financial planning software?

Because early-stage decisions (hiring, fundraising, and growth) all depend on cash visibility. Financial planning software gives founders real-time insight into runway, burn, and performance.

What’s the difference between financial planning and forecasting software?

Financial planning tools manage your overall budget and strategy, while forecasting software focuses on predicting future financial outcomes. Parallel combines both in one live system.

Can I use financial planning software without a CFO?

Yes. Modern tools like Parallel are designed for founders, giving you CFO-level insights before you need to hire one.

How does Parallel differ from spreadsheets or traditional tools?

Parallel updates automatically, models scenarios instantly, and produces board-ready reports, without manual formulas or broken links. It’s built specifically for startup founders.

Renato Villanueva

CEO & Cofounder